Governments the world over have been lamenting the lack of productivity growth for the last 15 years. In Australia this has been somewhat masked by our enormous population growth, which means that our GDP growth numbers look good on a headline basis but anaemic on a per capita basis. One standout explanation for at least part of this is the increasing proportion of companies in developed nations that meet the criteria of being zombie companies. Due to their over-indebtedness and lack of profitability, these companies tend to make investment decisions based on short term outcomes. Longer term investment in research, equipment and employees is cut back. Two recent articles on this topic caught my attention and together they show that the number of zombie companies is growing, and current policy settings point to this trend worsening in the years ahead.

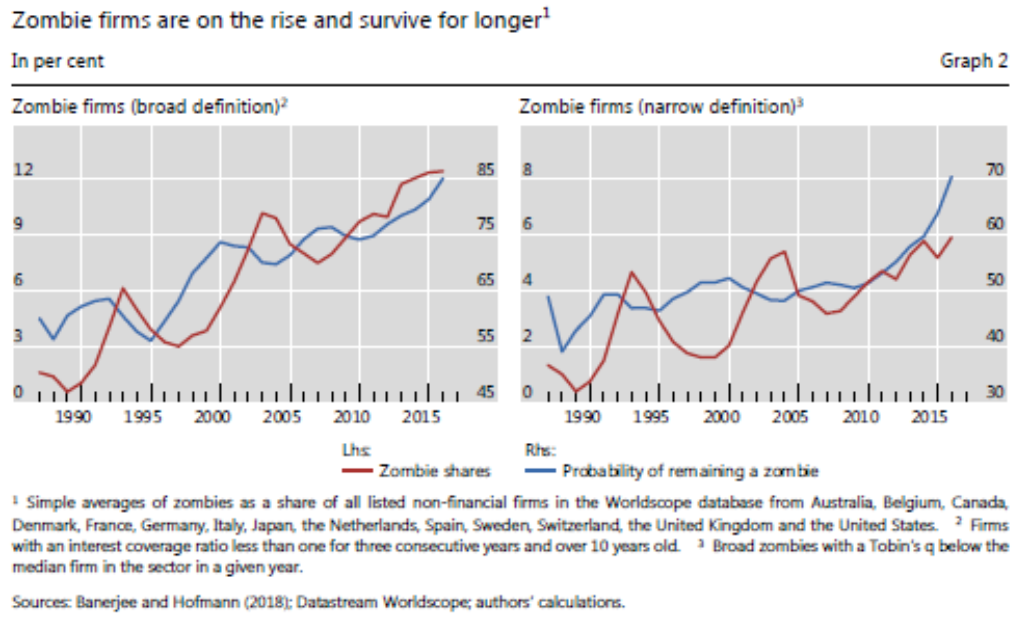

An outstanding recent paper from Ryan Banerjee and Boris Hofmann at the BIS dug into two basic questions on zombie companies; are their numbers growing and why? Their study used data from listed companies in the US, Europe, Japan and Australia and two definitions for what constitutes a zombie business. Their broad measure is based on market value relative to asset value and their narrow measure (a more common method) captures firms over 10 years old that do not generate sufficient profits to cover their interest obligations for three consecutive years. The graphs below show that either way, there are more zombie businesses and they remain as zombies for longer. This is bad news for economic growth. Zombie firms should be either recapitalised, taken over by a stronger company or bankrupted; so that their assets can be used more efficiently.

The conclusion of the report highlights the obvious trade off central banks have been making for the last twenty years.

Lower (interest) rates boost aggregate demand and raise employment and investment in the short run. But the higher prevalence of zombies they leave behind misallocates resources and weigh on productivity growth.

The second article was from Robin Wigglesworth at the Financial Times. He argued that countries should consider removing the tax deductibility of interest payments for companies. Whilst this would reduce the efficiency of capital structures for companies it would encourage lower debts levels and thus improve resilience.

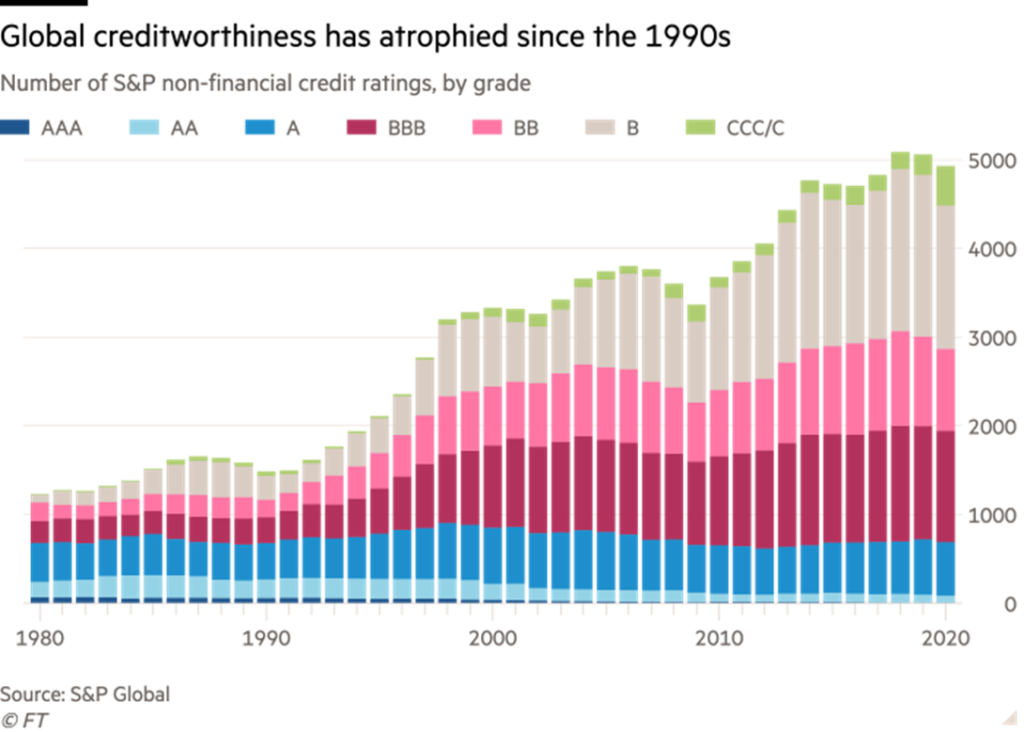

Robin included the graph below in the article, which shows three major trends over the last 25 years. First, companies that choose to have an investment grade credit profile have predominantly migrated to a BBB credit rating. Second, companies that choose to have a sub-investment grade credit profile have predominantly migrated to a B credit rating. Third, most rated companies are now choosing to have a sub-investment grade profile whereas 25 years ago most chose an investment grade profile. This all makes sense when the declining cost of debt is considered.

I agree with Robyn’s sentiments but disagree with his solution. Companies have become somewhat more ruthless in optimising their capital structures in recent decades. However, the key driver of this is that central banks have chosen to reduce overnight rates thus lowering the long term cost of debt. With the addition of quantitative easing, investment grade rated corporates are typically borrowing at rates less than 2%. In Europe, 29% of corporate bonds were trading at negative interest rates at the end of September. Removing the tax deductibility will make no difference for investment grade borrowers when their cost of debt is miniscule relative to their cost of equity.

For sub-investment grade borrowers their cost of equity can exceed 15% when their owners are private equity, venture capital or founder/family offices. The average yield on American B rated high yield bonds is just 5.52%, so again debt looks cheap compared to equity. Removing tax deductibility will have some impact but getting overnight rates back to normal levels of 4-5% is needed to cure the disease rather than merely address the symptoms.

Given central banks have no intention of normalising interest rates and unwinding quantitative easing any time soon, low interest rates will continue to allow for zombie companies to multiply. Economic growth will remain subdued, unemployment will be higher, and the cost of goods and services will be higher as productivity growth is suppressed. What has Japan has experienced for the last 30 years and Europe for the last decade is now our future. Welcome to the zombie global economy.