Using a combination of hard data, analysis and anecdotes, Dinny McMahon lays out why China’s economy must eventually face up to its great wall of debt

Debt

Is Australia Ready for the Next Financial Crisis?

Have governments and regulators acted to lessen the likelihood and severity of a potential downturn in Australia across the banking/financial system, monetary policy, fiscal policy, taxation policy and competition policy?

The Arguments Against Austerity are Simplistic and Short Term

Recent articles arguing against austerity lack logic and economic analysis. This article demonstrates why austerity is the better long term prescription.

BIS Nails the State of Global Corporate Debt

The Bank for International Settlements (BIS) quarterly report is always worth the read. Whilst it is academic in style and length, it consistently raises material that matters. Taken from the September report, the graphic below highlights the big issues for global corporate debt. The rest of this short article explains each component and its importance.

Emerging Market Debt: Dumb, Dumber and Dumbest

One of the classic signs that the credit cycle is nearing the end is that borrowers that shouldn’t be getting financed not only get funded, but get it at terms that seem crazy.

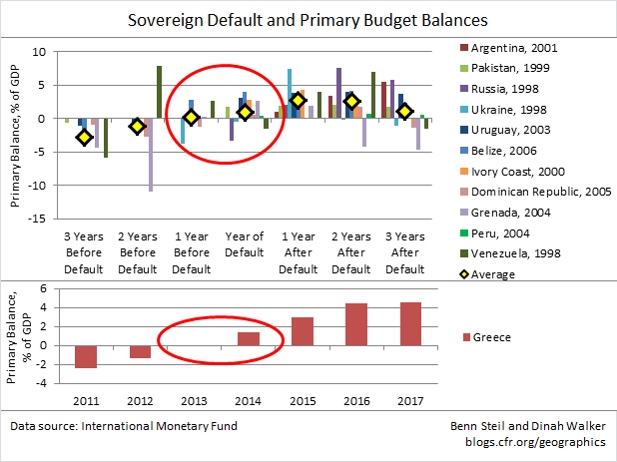

Beware of Greeks Selling Bonds? (A 5 C’s Analysis of Greek Debt)

This article uses the 5 C’s of credit to analyse the creditworthiness of Greece and to provide an opinion on the recently issued bonds.