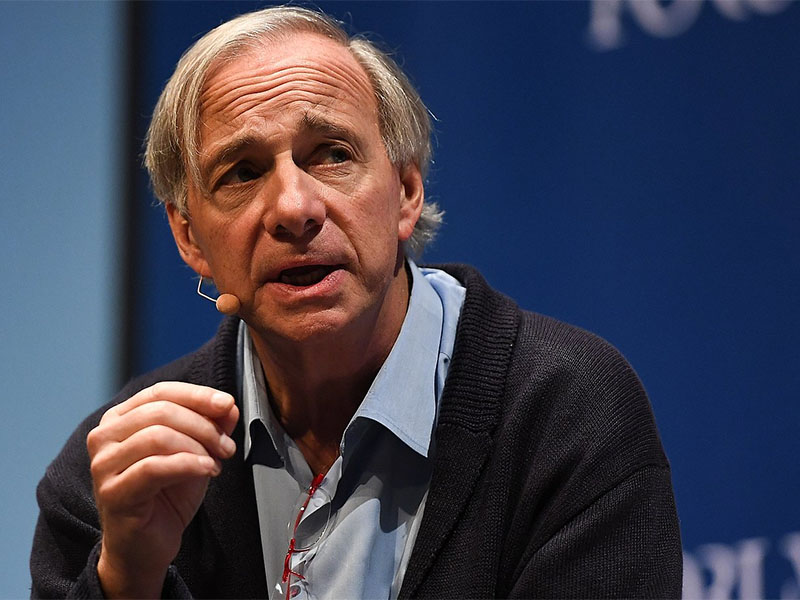

Ray Dalio has written a seminal book on debt crises in his recently released “A Template for Understanding Big Debt Crises”. In the first section, the book takes readers through the phases of a debt cycle, with a particular focus on government and central bank actions aimed at lessening the degree of the crisis. The second and third sections provide detailed and summarised examples of debt crises with a particular focus on Germany’s hyperinflationary period (1918-1924), the Great Depression (1928-1937) and the Global Financial Crisis (2007-2011).

In the introduction Ray notes that he is writing as an investor that must make real time decisions, not as a policy maker or historian. To understand how to manage capital through crises, he embarked on a process of reviewing historical crises as if he was living them. Ray argues that by understanding the economic phenomena in the lead up to each debt crisis he has been able to understand the outcomes of debt crises. Whilst written by an investor, the book is of great use to central bankers, bank regulators and governments who have tools at their disposal that could reduce the likelihood and severity of future crises. Ray’s description of how debt crises evolve should be compulsory reading for investors and policy makers alike.

Ray’s focus on credit creation and its stimulatory effect, followed by credit contraction and its depressionary effect is a simple but rarely acknowledged truth. Hyman Minsky isn’t named, but his work on the downward spiral of declining lending standards and the debt/asset price bubbles created by them has likely had a substantial influence on Ray’s conclusions.

The book provides a list of seven characteristics of bubbles, that readers can use to assess whether a bubble is building. These are: historically high asset prices, an expectation of rapid asset price appreciation, bullish sentiment, high levels of leverage, forward asset purchases, new buyers entering the market and stimulative monetary policy. All seven characteristics were evident in the US in 2000 (pre-tech wreck) and 2007 (pre-global financial crisis) and are arguably present today.

Ray’s Economic Disposition and Policy Recommendations

Readers familiar with the Austrian versus Keynesian debates will quickly peg Ray as a classic Keynesian. Almost all of the book is spent on critiquing responses to a crisis (Keynesian disposition) with almost no discussion of what would happen if there was no government/central bank/regulator interference (Austrian disposition). There is an appendix in the final ten pages on macroprudential policies, but this is mostly a list of historical macroprudential actions with no recommendations on how bank regulators should lean against bubbles.

The book details the four ways for dealing with debt crises: cutting spending, raising taxes, printing money and default/restructuring of debts. Ray argues that cutting spending and raising taxes are “big mistakes”, as they will have an immediate negative impact on incomes without doing much to correct excessive debt to income ratios. He prefers money printing and debt restructurings, which have much more immediate impacts in increasing incomes and decreasing the debt burden respectively. This too is a classic Keynesian argument, in that it focuses on the immediate response to a crisis whilst ignoring the long term moral hazard consequences.

Whilst Ray has strong views on how best to fix a crisis (lower interest rates, money printing and debt restructurings), he expresses close to no view on how to prevent a crisis. He is fairly definitive on when and how stimulus should be applied but is vague on when it should be withdrawn. The book is almost completely silent on the long term negative consequences of low interest rates and quantitative easing (e.g. debt/asset prices bubbles). Ray’s recent comments criticising central banks for normalising monetary policy too quickly are bizarre, given arguably all of his characteristics of a bubble are currently evident. Austrian minded thinkers will be left shaking their heads at this inconsistency.

Debt Restructurings and Debt Jubilees

When a debt/asset price bubble has occurred, it is a natural outcome that some debt restructurings will be required to cleanse the economy of bad debts. Ray sees the key questions as:

- which institutions are bailed out and which are left to fail (who is and isn’t systemically important); and

- who bears the losses (e.g. lenders/investors or taxpayers, foreign and/or domestic creditors).

The book correctly notes that governments and regulators typically take substantial time to recognise the severity of the problems. As a result, piecemeal solutions are often implemented delaying the recovery. Whilst not mentioned in the book, Greece and Japan would be good examples of this slow progress in recognising unserviceable debts.

The book mentions but doesn’t expand on the Biblical concept of a debt jubilee. This is different from debt restructurings in that the debt is forgiven in a debt jubilee with the borrower retaining the assets. In a corporate or personal debt restructuring, the borrower’s assets are typically given over to their lender/s in return for the debts being reduced or cleared.

The debt jubilee concept holds some popular appeal, but it is only supported by a handful of fringe economists. Almost all economists recognise that an unexpected debt jubilee would be theft, stripping prudent savers of their assets to enrich reckless speculators. A collapse of the banking system with enormous losses for savers would be an inevitable outcome of a debt jubilee. Ray correctly observes that debt restructurings are an inevitable part of debt crises, but debt jubilees are a radical response most frequently associated with regime change.

Conclusion

Ray’s book is definitely worth reading, particularly for its methodical treatment of the lead up to and characteristics of debt crises. Investors and policy makers can benefit from recognising the warning signs that a debt crisis is approaching. However, readers should take a sceptical view of Ray’s recommendations for resolving debt crises, noting that his prescriptions for action have often become the cause of the next debt crisis. I commend Ray for making the book available for download at no cost.