The old saying that history doesn’t repeat but often rhymes sums up the fervour surrounding cryptocurrencies and blockchain. The media loves to write about something new and sexy and the financial media loves to write about those things as well, especially when they involve volatile asset prices. As cryptocurrencies and their underlying technology, blockchain, satisfy all of those characteristics there’s daily coverage of their latest developments.

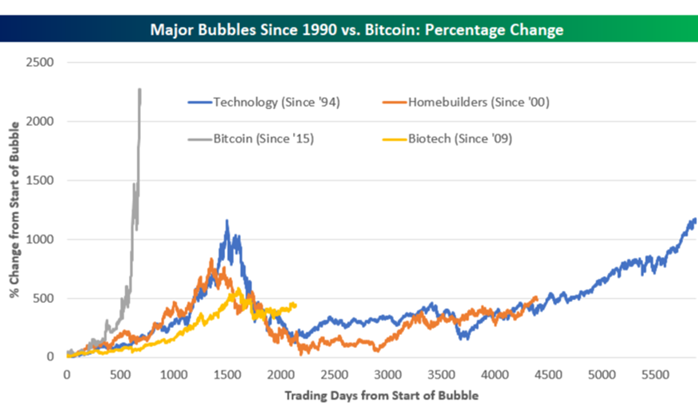

Investors often fall for shiny new toys as well. The original cryptocurrency, Bitcoin, has risen from mere cents in 2010 to over $3,500 today. Some speculators use these returns to extrapolate a story of massive potential future returns for Bitcoin and the over 900 other cryptocurrencies. A more pragmatic view is to see these returns and the wave of new cryptocurrencies issued each week as a sure sign of a speculative bubble. Two examples from the 1990’s can help us understand the mania surrounding cryptocurrencies and blockchain and their likely futures.

Cryptocurrencies and Baseball Cards

In 2010 Dave Jamieson wrote Mint Condition, the seminal book on the baseball cards bubble of the late 1980’s and early 1990’s. In this recent interview on Bloomberg Odd Lots he describes the background, the build-up and the eventual fall of this bubble. Baseball cards went from being a niche hobby to a big business in the space of a few years. Many new entrants began producing cards, flooding the market with variations on what is essentially a picture on a piece of cardboard. For some the cards became an alternative form of currency, with kids and adults alike buying them with a view that the prices would increase and they would make a fortune. It was a classic Ponzi bubble.

The development of cryptocurrencies today mirrors that of baseball cards. In the space of a few years we’ve gone from a handful of alternative currencies to dozens of initial coin offerings (ICO) a week. Each ICO claims to offer a unique angle on why it should flourish, but few pass the sniff test. For instance, developing technologies for the dental industry is a reasonable aim, but why fund it through the issuance of Dentacoin? Even Dogecoin, which was created as joke on the cryptocurrency scene, reached a market capitalisation of $400 million.

The future of cryptocurrencies will involve almost all of them dying off with only a handful surviving. Alternatives currencies do serve a purpose for those looking to engage in illegal activities or who need a way to get their money out of a country with a closed currency. (E.g. China or Venezuela) However, that’s thought to be a very small part of the current buyer base and there are many alternatives to cryptocurrencies to transmit wealth.

For those concerned about the value of fiat currencies in a time of central banks printing money, gold or real estate are better ways to protect wealth. Unlike alternative currencies, which have a near endless supply at close to no cost, there’s a very limited supply of these assets. The regular thefts of cryptocurrencies are another disadvantage, which is difficult to overcome without giving up anonymity. There’s no good reason to think that cryptocurrencies are any more valuable than a picture on a piece of cardboard.

Blockchain and the Internet

Unlike cryptocurrencies, blockchain has a decent future but it’s not worth the hype it is getting. Blockchain is a good way to store information and enable transfers, giving it the potential to replace many non-automated databases. However, the fanboys of blockchain have forgotten the lessons from the internet boom of the late 1990’s and are repeating the same guff about blockchain taking over the world.

Some of the hype about the internet boom has ultimately turned out to be correct, but it took far longer than expected and few survived to make a decent profit. Whilst people can order and purchase all sorts of things via the internet, even today US online retail spending is less than 10% of total retail sales. A handful of internet based businesses have thrived, but far more fell along the wayside as they simply couldn’t turn their hype into sales and profits. In many cases it wasn’t the technology at fault, it was that businesses and consumers simply didn’t want what was being offered.

Blockchain’s implementation is likely to follow the same pathway. Whilst blockchain can offer obvious improvements such as lower costs, faster transactions and lower error rates, many businesses will take a long time to adopt new technologies. In the finance sector, there are a myriad of outdated processes that can be improved. But banks, with their history of slow adaption and risk avoidance, won’t be rushing to change everything. When they do make a decision to change they will most likely do the work inhouse or engage contractors to retain ownership of the intellectual property. Only a handful of blockchain developers (or some other technology like it) will earn super-profits by developing solutions and charging clients on a per user/usage basis as Microsoft, Oracle and SAP have done.

Conclusion

Cryptocurrencies and blockchain are the shiny new toys of this era, drawing in the attention of many and speculative investment of a few. Like the baseball cards and internet bubbles of the 90’s, these two sectors will almost certainly fail to live up to the hype. Cryptocurrencies are a Ponzi bubble just like baseball cards were. The lack of any material asset backing and the near endless minting of new currencies all but guarantees that only a few will survive with the vast majority becoming worthless. Blockchain can solve many database and asset transfer problems but the profits from its development are more likely to go to old industries that adapt to it than developers who create solutions. Investors are best placed by sitting on the sidelines and seeing how these bubbles shake out.