The rapid decline in residential properties available for rent points to a greater proportion of low income Australians becoming homeless

Money

MMT’s key claim is true but simplistic

MMT’s claim that governments can print money is true, but there’s substantial negative consequences which are neither immediate nor blatantly evident to the untrained observer

Could Austria’s Century Bond End Up Like Argentina’s?

It doesn’t take a default for Austria’s recently issued century bond to trade at the same price as Argentina’s defaulted debt.

When the Truth is this Crazy, Who Needs Conspiracy Theories?

The insolvency of Wirecard has made many look foolish, but short sellers and a journalist had been on the case for years

Investors are Chasing “Bargains” in Turnarounds and Cyclicals

In the search for an apparent bargain, turnaround stories and cyclical companies are attracting far more capital and attention than they otherwise would.

Two Cheers for APRA on TLAC

APRA deserves credit for rejecting the false claims of the major banks and ordering a substantial increase in their tier 2 capital

What is “Cash” and Why it Matters

There’s a great deal of confusion over cash, enhanced cash & investment grade funds. Let’s clarify the purpose & underlying securities of each type of fund.

The Coming High Yield Downturn will be Big, Long and Ugly

The US high yield market has grown larger and riskier since the financial crisis. More debt, of lower quality, with weaker covenants means the coming downturn will be bigger, longer and uglier.

Cryptocurrencies and Blockchain are Just Reruns of 90’s Bubbles

The old saying that history doesn’t repeat but often rhymes sums up the fervour surrounding cryptocurrencies and blockchain.

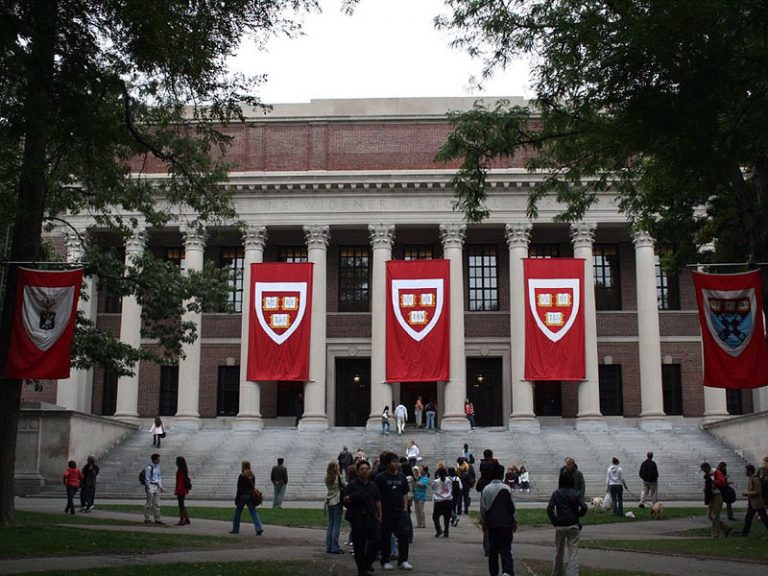

Harvard Shows the Pitfalls of Internalising Funds Management

With so many fund managers overcharging and underperforming it’s no surprise that there’s a trend towards internalising funds management. However, Harvard’s experience shows that internalising is far easier said than done.