Covenant Lite You know it’s late in the credit cycle when credit investors give away their key protections in return for just a little more yield. This acquiesce comes in different forms, including higher levels of leverage, longer dated debt, subordinated debt and weakened or eliminated covenants commonly referred to as “covenant lite”. This risk […]

Credit

Credit Snapshots – March 2018

Bite size updates on the Libor spike, Toy’s R Us, franking credit changes and the Banking Royal Commission

Credit Snapshots – February 2018

Bite size updates on US government debt, Chinese margin lending and bank capital

Credit Snapshots

Bite size updates on high yield spreads, Puerto Rico, Venezuela and China.

The Truth about Liquidity for Debt Securities

This article corrects much of the current discussion about liquidity for debt securities and puts forward the key things to focus on.

Why Volatility Matters for Credit Investing

This article discusses why credit investors should consider the potential volatility of the companies they lend to with examples provided of good and bad risks

Four Dangerous High Yield Credit Myths

This article debunks four common high yield credit myths and explains the actual triggers and warnings signs of a downturn in credit markets

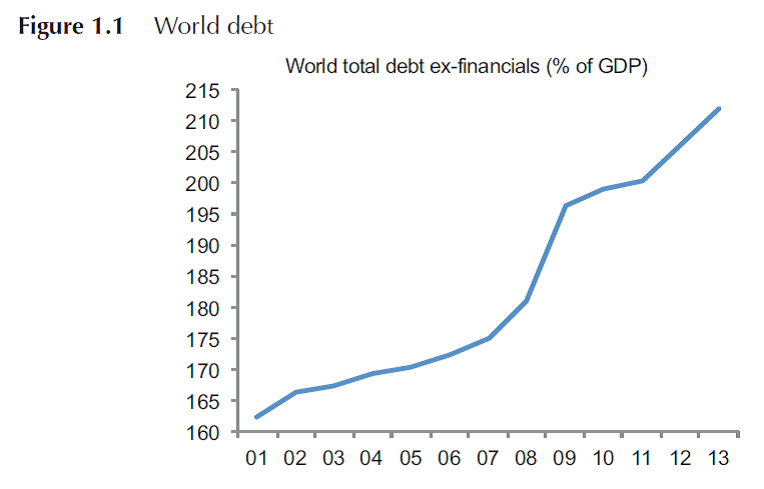

Is a Debt Bonfire Building? (Issues with the Quality and Quantity of Debt Outstanding)

This article summarises three major pieces of research that highlight potential issues with the quality and quantity of debt outstanding, and the implications for investors.

Are Bonds Liquid?

This article examines proposals to improve the liquidity of bonds and explores why liquidity is important to many investors and fund managers.

The Beginner’s Guide to Peer to Peer Lending

This article covers the development of P2P lending, its future prospects and recommendations on how potential lenders should analyse loan risks.

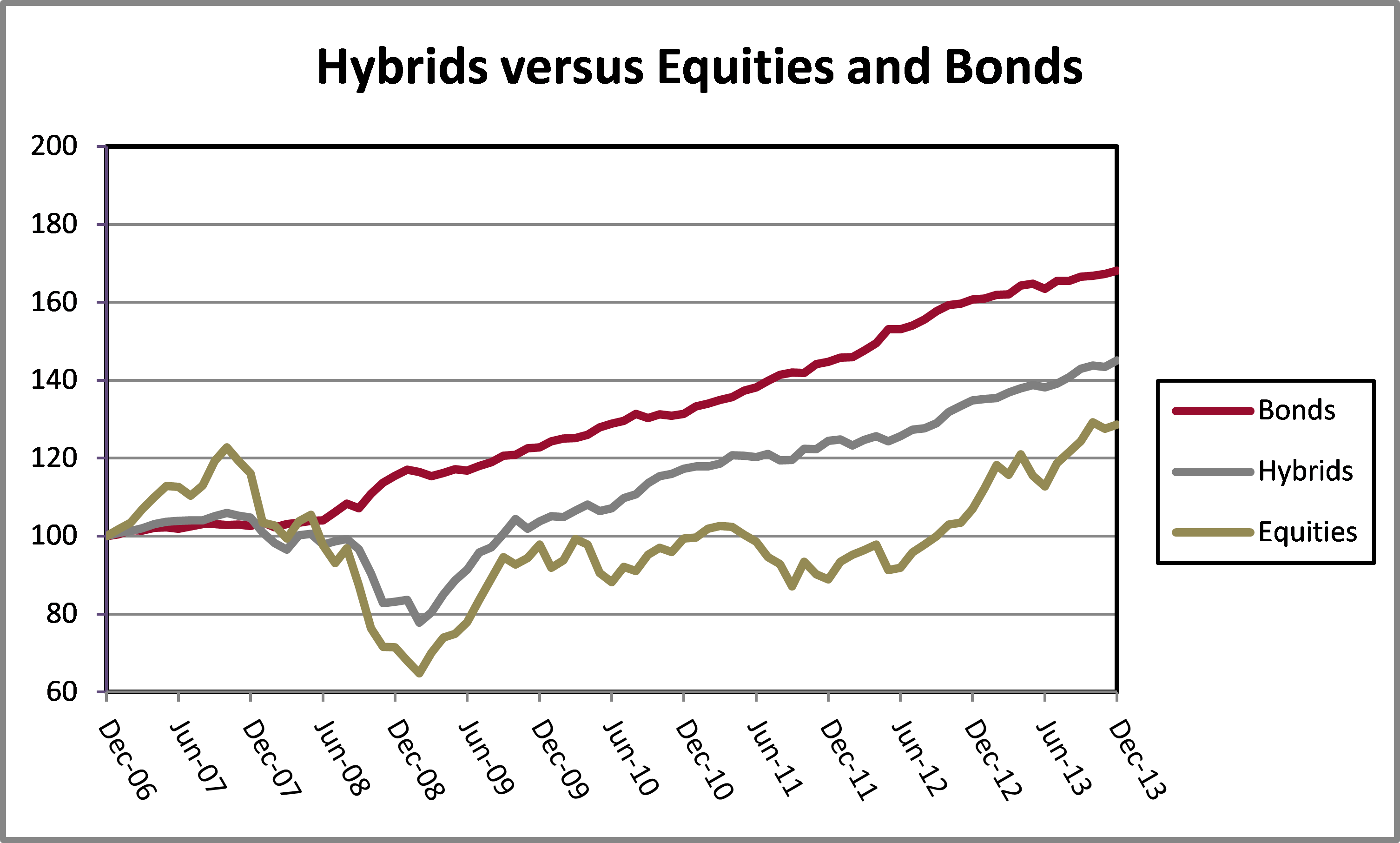

The Perils of Preference Shares

This paper analyses the weaknesses of preference shares, using recent Australian examples to illustrate the issues.

Taking the Heat Out of Home Lending

This article details specific measures banks should take beyond current prudential guidelines to de-risk their home lending operations in advance of a potential fall in house prices.