The selloff in risk assets this month was predictable in its occurrence, but the timing is always the unpredictable part. US equities had been expensive by almost every metric on a historical basis, with the outliers being earnings yield and dividend yield relative to ten year bonds. A move upwards in bond yields made it difficult to see any reason for equities to remain as expensive as they were.

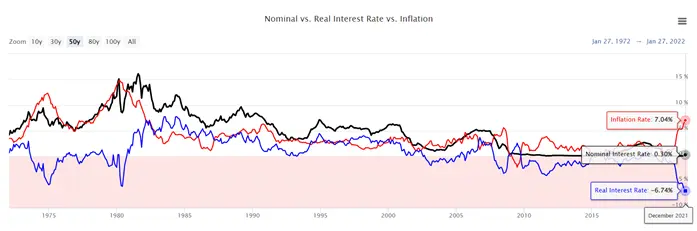

It is also understandable why asset prices had reached such high levels. The graph below from Longtermtrends.net shows the massive negative real returns on cash that investors have been facing recently. Negative real returns have been in place most of the time since 2009, which is an awfully long time to gradually boil the proverbial frog. Central banks have been deliberately punishing investors in cash and investment grade bonds, hoping that by forcing them out of these asset classes they would invest in other sectors, kicking off the wealth effect.

Whilst the impact of higher asset prices on consumer spending is debateable (lower returns on low risk assets dampens spending by retirees) the impact on asset prices has been clear. Investors bullied out of lower risk assets have forced up the prices of higher risk assets, with sub-investment grade bonds, equities, real estate and infrastructure obvious beneficiaries. However, over time these sorts of shifts move from regular assets to speculative assets, as the future returns on regular assets are forced down by higher starting prices.

As first this trend tends to be seen in growth stocks, in both the IPO and venture capital segments, starting with companies that are generating decent revenues but with strong prospects for rapid growth. After a while, recently established business with little more than an idea and a slide deck are allocated large slabs of capital. Eventually it is “assets” with no business case like cryptocurrencies and NFTs that attract money as the speculative frenzy takes over. Without negative real interest rates and quantitative easing, these speculative (and arguably Ponzi) endeavours would have remained niche collectables largely ignored by mainstream financial markets.

Now that short and long term interest rates are rising, as well as electronic money printing being slowed or reversed, asset prices are being revalued. Normally, the prospect of a recession accompanies a slump in asset prices with the 2007-2009 period being a helpful guide. However, this time the starting point and trigger is somewhat different from historical examples.

Developed economies are generally in very good health with low unemployment and having had a solid bump in consumer savings from enormous fiscal stimulus and lockdown restricted spending. The corporate sector as whole is also cashed up, though there is a significant segment that is either (i) unprofitable and dependent upon future capital raisings or (ii) breakeven and dependent upon rolling over high debt levels. Fiscal stimulus and budget deficits will reduce, but austerity remains a dirty word by the majority who fail to realise it is an inevitable reckoning when governments overspend.

Those focussed on interpreting central bank mutterings have realised that overnight rates will increase faster and sooner than expected, and quantitative easing will stop sooner than expected. What I haven’t heard yet is a central bank committing to positive real interest rates. This indicates that whilst central banks are responding to the political pressure to do something about inflation, they aren’t fully committed to normalising monetary policy.

Pulling all this together, I see fiscal and monetary policy being stimulatory, but less than it has recently been. Consumers are likely to keep increasing their spending though business investment will slow somewhat as the cost of capital pushes up. There’s also plenty of economic activity that has been held back due to government restrictions and people being cautious, so there will be a natural reversal of that. A situation where very long duration debt, equities and other higher risk assets fall by 20% or more whilst developed economies continue to grow seems quite plausible. It would also be a reversal of the last 18 months when economies have suffered whilst asset prices rose.