US Government Debt

With the increase in the American overnight rate and long term bond yields questions are starting to be asked about whether the federal government debt load is sustainable. As interest rates increase, so does the interest bill. Neither major political party seems to care, they have taken turns at making the deficit worse. President Obama is the reigning debt champion, but Trump might overtake him with the national debt spiking by $1 trillion in the last six months.

The tax cuts recently passed will materially increase the deficit and it is hotly debated whether the growth it spurs will be a sufficient offset. One thing that can’t be argued against though is that there’s no free lunch, deficits eventually must be repaid and will be an anchor on long term growth. Private sector debt has also been growing at a decent clip and whilst crowding out isn’t an issue yet it could make a comeback. The old Keynesian principle of deficits in the bad times paid off with surpluses in the good times still applies. Greece and Venezuela serve as a reminder of what happens to those who ignore it.

Margin Lending in China

Whilst margin lending in the US is at a level that has some concerned, in China it’s in another league. 317 companies listed on the major exchanges have 40% or more of their shares pledged for margin loans. With the recent correction in share prices, that’s created a major problem. To avoid shares being forcibly sold in margin calls 10% of companies suspended trading in their shares. Normally a securities regulator would step in and stop these shenanigans but in China the securities regulator has responded by ordering major shareholders to stop selling and start buying. It’s not the only strange thing occurring, the volatility index stopped publishing the daily measurement during the recent volatility spike.

I recently wrote about margin lending, noting that it can be a safe form of lending when the collateral is liquid and low volatility. The way Chinese capital markets are run neither of these two factors applies. By allowing these practices to continue China increases the likelihood that its capital markets will experience disorderly sell-offs in the future. Attempts to shield investors from material losses in the stock market, shadow banking and residential property allows bubbles to inflate far longer than would otherwise occur.

Australian Bank Capital Levels

APRA has released two discussion papers capital framework and leverage ratio) relating to capital levels for Australian banks. The papers aim to solicit comments by the end of May with draft prudential guidelines due by year end. There are two major changes as part of these reviews; (1) limiting the gaming of internal capital calculations and (2) ascribing different risk weights to residential mortgages based on key factors such as the loan to value ratio (LVR).

The 2017 global reforms to Basel III included a floor of 72.5% on risk weights, where the internal capital calculation is the numerator and the standardised capital calculation is the denominator. This matters as some of the major banks were holding less than 40% of the capital that regional and smaller Australian banks were holding for the same risk. The gap will now need to be closed somewhat. The global policy timeline has a 50% floor applying from 2022 increasing to 72.5% by 2027. APRA is wisely ignoring that glacial timeline proposing that Aussie banks must fully comply by 2021.

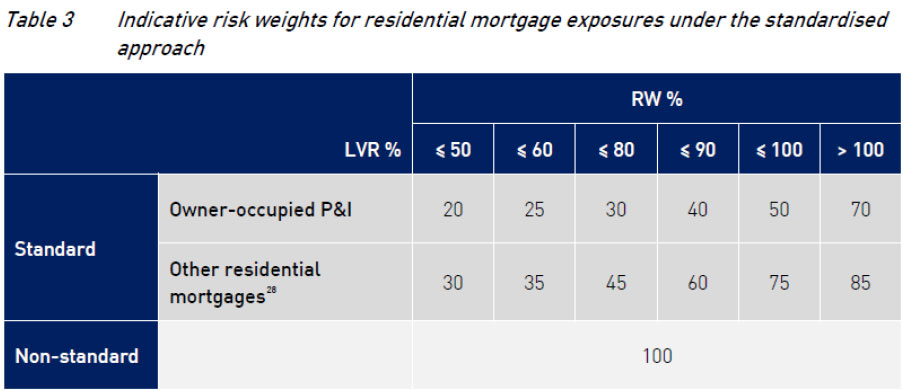

The table below shows the proposed changes to risk weights for residential mortgages. Owner occupiers making principal and interest repayments with lower LVRs are considered lower risk and will attract lower levels of capital. Borrowers with higher LVRs and/or investment loans and interest only loans are considered higher risk and require more capital. Mandating more capital for higher risk loans is eminently sensible policy and already applies for corporate lending.

There are several important outcomes from these changes. First, major banks had used internal calculations and higher LVR loans to make higher profits whilst carrying proportionately less capital but those games are coming to an end. Second, risk based pricing is likely to emerge for different LVRs. The interest rate increases experienced by investor and interest only borrowers point to what could be coming for high LVR borrowers. Most particularly impacted will be interest only investors that have been using the paper equity built by increasing house prices to support further purchases and borrowing. This group will find it increasingly difficult to rollover their existing interest only loans and are likely to face higher interest rates if they do.

The one area not mentioned in APRA’s update is total loss absorbing capital (TLAC). APRA continues to drag its feet on this issue, which is the most important pending reform. As recently laid out by Bloomberg, there’s no easy way to let a bank fail. The solution to cheaply reducing the likelihood of bank failure is more subordinated capital. Now is an ideal time to instruct banks to increase their additional tier 1 and tier 2 capital levels as margins on these securities are particularly low. Overall, it’s a bouquet for the capital floor and risk based pricing but a brickbat for ignoring TLAC.