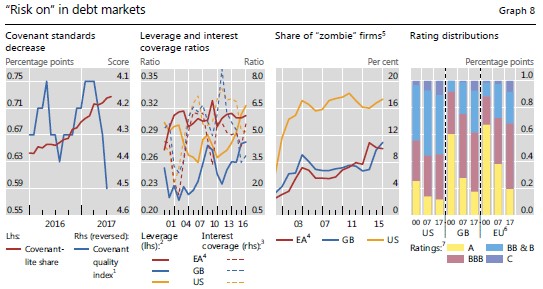

The Bank for International Settlements (BIS) quarterly report is always worth the read. Whilst it is academic in style and length, it consistently raises material that matters. Taken from the September report, the graphic below highlights the big issues for global corporate debt. The rest of this short article explains each component and its importance.

The first graph shows that covenant quality is worsening and the proportion of debt without meaningful covenants is increasing. Lenders are competing against each other by offering borrowers weaker covenants (which increases the probability and severity of defaults in the long term) as well as lower margins. Covenants have become so uncommon investors automatically assume that the borrower must have problems if their new loans include covenants. The second graph shows that leverage is generally increasing whilst interest coverage is falling. Both of these trends point to higher risk in debt markets.

The zombie firms of the third graph are defined as companies at least ten years old that have earnings (EBIT) less than their interest bill. These firms have limited ability to invest in growing their businesses as their earnings are consumed by their debt repayments. In a normal environment, these firms would restructure their debts or be liquidated, but the loose credit environment has allowed them to continue operating as is. A good example of a zombie firm is Toys R Us, which struggled for years with excessive debt and underinvestment. In September it filed for bankruptcy, something of a rarity given debt markets will fund almost anything at the moment. The bankruptcy process should greatly reduce the company’s debt, allowing it to invest and compete fully again.

The last graph is arguably the greatest warning of the four. It shows that relative to 2000 and 2007, which were peak years for the previous credit cycles, the quality of debt outstanding is worse. The proportion of investment grade rated debt (A and BBB ratings) is noticeably lower in Great Britain and Europe. The lowest quality debt (C rating) has increased substantially in all regions. When the global economy next weakens, there are plenty of companies that won’t be able to service their debts. US leveraged loans are on track to break the issuance record set in 2007, another sign of the bullishness in global credit.

Whilst these graphs all relate to corporate debt, sovereign debt is showing the same deterioration in quality. Last month I described lending to Argentina, Greece and Iraq as dumb. This month I’ve written about the lunacy of lending to Tajikistan. It wouldn’t surprise me if North Korea was able to get a loan soon, although it might have to be funded through Chinese wealth management products to get around the sanctions!