Submission to the Housing Affordability Committee

Dear Committee Members,

I have noted the enthusiasm that committee members have shown thus far in addressing the problem of the lack of affordable housing in Australia. This is positive, however the true test of political action is the outcomes achieved not the intentions. Many committees and enquiries have preceded this committee, looking into this issue. My experience in making submissions and corresponding with these committees is that they too were well intentioned but lacked the courage to implement the obvious and necessary reforms.

Vested interests including the property and construction industry, existing homeowners and politicians who own far more property than the average Australian consistently get in the way of meaningful reform. Enquiries and committees inevitably make weak recommendations, often pointing to reforms that another level of government must implement rather than acting within their remit. Australia’s federal government can meaningfully reduce the cost of housing by making changes directly under its control, as well as by using its funding of the states to apply pressure to state and local governments to do their part.

Accompanying this submission are several papers I have written on the wider topic of housing affordability in recent years. The key issues have not changed and the recommendations in these historical articles remain valid. In order to assist the committee I will begin with some background notes and brief comments on the top five reforms that the committee should consider.

The housing market is actually two markets

One common misconception is that housing affordability is just one issue. However, the ability to afford the rent on a property and the ability to afford to purchase a dwelling are two different problems. The solutions to each are somewhat different, though often interrelated. The committee should start with the lack of affordable rental property as the key issue, as housing is first and foremost a place to live and second, an investment opportunity. Low income Australians do not have an alternative to housing as a place to live, wealthier Australians do have alternative investment opportunities.

Rental affordability

Rental housing is primarily a supply and demand equation. If the supply of housing grows faster than the population, there will be more properties available for rent and rental affordability will improve. Australia has for many years under built new housing relative to population growth. This has seen the poorest Australians need to devote more of their income to housing over time.

If governments actually want to help poorer Australians, the two biggest things they can impact are the availability of work and the availability of affordable housing. The Covid migration changes have clearly shown that if Australia stops importing low skill/low wage people the cost of rental housing will fall and the unemployment rate will fall. The combination of higher employment/wage levels and a lower cost of housing can substantially lift the living standards of hundreds of thousands of the poorest Australians if federal politicians don’t stuff it up by importing hundreds of thousands of people.

Recommendation 1 – Limit migration to those earning more than $150,000 per year

The fact that international borders have been largely closed provides an opportunity to permanently reset migration levels at a small fraction of what they were. Those granted the right to migrate to Australia should be people expected to contribute disproportionately to the tax base. The minimum income test should be set at a high level such as $150,000 per year to ensure that employers are not shirking their responsibility to train Australians for ordinary jobs.

At the low skill end, the number of working holiday visas should be slashed. Unemployed Australians in regional and rural areas can be put to work on farms and those in the city can get to work in cafes and restaurants. University students (both domestic and international) will continue to provide a sizeable pool of low skill labour. International students should be given fair warning that few courses are likely to lead to permanent visas.

The shift away from population growth should cause a shift towards productivity focussed economic growth. I’ve written about this many times, with much low hanging fruit to be picked amongst excessive regulation and government spending, high and inefficient levels of taxation and anti-competitive government/business practices. Something as obvious as having a simple and universal minimum wage for small and medium sized business could see businesses expand and unemployed Australians shifted into work, leaving almost everyone except the lawyers better off.

Recommendation 2 – Set a target to build at least 20,000 dwellings per month for 3 years

This recommendation is trickier as it relies more heavily on state and local governments for its implementation. State and local government restrictions that block property owners from maximising their land’s value have been the biggest impediment to housing supply keeping up with excessive population growth. However, with appropriate fiscal carrots and sticks, the federal government can incentivise the current housing boom to continue in the medium term.

In a true free market, such incentives would not be needed as those who own land would be free to develop it to maximise its value. This would naturally mean more greenfield house blocks in fringe suburbs and higher density in brownfield areas. Incentives could include direct payments to state/local governments based on the number of housing starts or the withholding of funds if they fail to meet targets.

There should be a wide scope for different housing types within this including detached houses, low and high rise dwellings and manufactured housing. For some low income groups, such as retirees without savings, manufactured housing villages built on cheap land in fringe suburbs or in coastal communities should be encouraged. Younger age groups typically need good proximity to work and schools, which can require multi-room units in brownfield areas.

The committee should largely ignore suggestions to set targets for building designated affordable housing. Australia needs hundreds of thousands of new dwellings to bring affordable housing to the whole population. Government programs that build or incentivise the building of mere thousands of dwellings available to selected groups (e.g. “key workers”) make no meaningful difference to the overall affordability of rental properties.

Purchasing affordability

The ability to afford to purchase a property is more complex than a simple supply and demand equation. The RBA Cash Rate, tax settings and the availability of credit can all substantially impact the price of a property just as they impact many other investment sectors. Three additional recommendations accompany these areas.

Recommendation 3 – End financial repression

Financial repression describes measures used by governments to hold down interest rates. This is effectively a tax on savers with the benefit transferred to borrowers. As the federal government is increasingly indebted after years of budget deficits it benefits from low interest rates. By setting the inflation target for the RBA too high, the federal government is unofficially taxing savers for its own benefit.

The global evidence on the effectiveness of ultra-low interest rates has become clearer now that more than a decade has passed since implementation. Ultra-low interest rates have not materially increased wages, consumer price inflation or business investment. Ultra-low interest rates have inflated asset prices, including Australian housing. Lower interest rates reduce the monthly repayment required to repay a loan. Many buyers have used lower interest rates to increase the amount they borrow rather than borrowing the same amount and repaying it faster.

The federal government should amend the RBA’s current inflation target of 2-3%. It could be changed to keeping inflation below 3% or to target an inflation band of between -3% and 3%. To prevent financial repression the RBA should also be required to ensure that the cash rate allows all citizens to receive a positive after-tax real rate of return. This can be expressed as:

An independent RBA should embrace this rule as it will stop the federal government from using financial repression to deal with budget deficits.

Recommendation 4 – Tax reform

For the sake of brevity and given substantial government reviews of this area in the last decade;

- Switch stamp duty for land tax

- Lower and equalise the income tax rates across personal, company and trust income

- Treat all income equally (the same tax rate for work income, interest/rent income and capital gains)

- Broaden and increase the GST to cover the reduced revenue after income tax cuts

- Cut federal government payments to state governments to reflect lower income tax and higher GST collections

Recommendation 5 – Macroprudential reform

The ability to leverage up a minimal deposit and/or the ability to more relative to your income creates an arms race amongst buyers. The one who borrows the most can bid the most. However, the “winning” bidder may ultimately end up losing the most in an economic downturn that is accompanied by a house price correction. The RBA has worsened this with its monetary policy decisions (see recommendation 3) and APRA has failed to respond whilst house prices have run higher. Two simple measures can address the building systemic risk in residential property lending;

- Ban lending where the debt to income ratio exceeds six times

- Ban lending where the LVR exceeds 90%

Final comments

The lack of affordable housing is almost exclusively due to poor government policies across federal, state and local governments. There is no one reform that can fix all of the poor policies that together have led to Australia being a world leader in unaffordable housing. The above recommendations are aimed at correcting existing government policies and thus allowing all Australians to have access to low cost rental accommodation. The recommendations will also assist those wishing to purchase a property, subject to them also having adequate income and savings to be in a financial position to afford to purchase a property.

The committee should avoid any schemes that involve governments underwriting or subsidising high risk loans to those who have insufficient savings or income to afford their preferred form of dwelling. These schemes encourage potential homeowners to save less, borrow more and buy more expensive properties. They can trap borrowers in homes and loans that are not suitable if their work, family or financial situations change.

Several historical articles on key aspects of housing affordability are attached for convenience and further reference.

Written by Jonathan Rochford for Narrow Road Capital on October 4, 2021.

Historical Articles

If Australian Politicians Cared About Housing Affordability Here’s What They Would Do

This coming Friday the federal and state treasurers will meet to discuss housing affordability. In recent years there has been no end of empty platitudes from politicians on this issue with little meaningful policy reform. Federal and state politicians prefer to blame each other rather than undertaking basic research and policy development to deal with the excessive cost of housing. In light of this gridlock, this paper lays out eight actions politicians can take to make Australian housing affordable again.

Key Principles for Housing Policy

Before explaining each of the eight changes it is helpful to have basic principles that underlie the approach to change.

- Housing is first and foremost a place to live and secondly an investment opportunity. Low income Australians do not have an alternative to housing as a place to live, wealthier Australians do have alternative investment opportunities.

- Affordable rental accommodation is a necessity, affordable housing for purchase is a nice to have. Government policy should prioritise increasing the amount of affordable rental properties, and in doing so the cost of purchasing dwellings should fall.

- Making housing more affordable means that existing property prices are likely to fall. Governments should not try to protect wealthier property owners from price falls in housing or any other investments.

- Governments must accept that the cost of housing is ultimately determined by market forces. The focus must be on long term demand and supply factors. Policies that attempt to mandate the construction of a small portion of affordable housing won’t work if the overall demand exceeds supply.

With the principles for change laid out, here are the eight recommended actions.

Reduce the Migration Intake

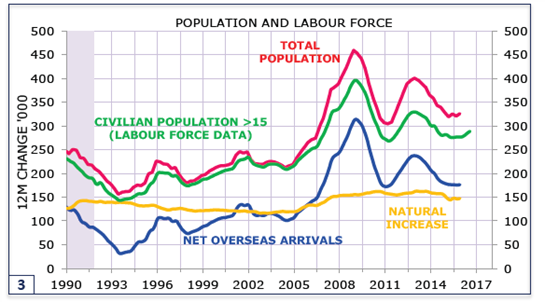

The primary driver of the demand for housing in Australia in the last ten years has been very strong population growth. In the last decade population growth in the US was 0.8% per annum and in Europe 0.1%. In Australia, the population has increased from 20.4 million to 24.1 million, equating to 1.7% per annum. As shown in the graph below natural growth (births minus deaths) and migration have both contributed to a population surge.

A lack of affordable housing is just one of the costs that Australians are paying for rapid population growth. Increased travel time to work and recreation as roads and public transport become more crowded is another obvious cost. Increased state and federal government spending on roads, public transport, schools and hospitals to accommodate the additional demand for services is another.

The preoccupation with headline GDP growth, which is in large part due to population growth, means ignoring the negative impacts on GDP per capita and quality of life. This is particularly apparent in the high growth cities of Sydney and Melbourne where most migrants choose to live. Given the population growth, it is no surprise that these two cities have seen far larger growth in house prices in the last decade compared to Brisbane and Perth.

The make-up of Australia’s migration intake shows that much can be done without dramatic changes. Family migration and the majority of skilled migration could be curtailed with little negative impact. Skilled migration should be limited to specialist occupations that Australians cannot easily be trained to fill. For example, there are millions of unemployed and underemployed Australians who could be quickly trained to be chefs. Australian restaurants need to train more chefs and pay higher wages to attract potential employees rather than importing chefs. There is also an issue with willingness to work amongst some Australians. Australia relies heavily upon seasonal workers and backpackers for fruit picking when regional areas have amongst the highest youth unemployment rates.

Lower and Equalise Income Taxes

The debate over negative gearing and capital gains tax deductions is often cited as part of the housing affordability problem. However, the underlying issue is that the top marginal tax rates are too high, thus higher income Australians seek out these schemes in order to maximise their after-tax investment returns. Australia needs to have lower and simpler income tax, with all individuals, companies and trusts subject to a top marginal tax rate of 20-25%.

A lower top tax rate would be accompanied by removal of loopholes, with capital gains tax reductions for assets held over 12 months eliminated. These changes would incentivise work, saving and investment in balanced ways, rather than the existing system that penalises work and rewards property and equity investments. The funding for a lower but broader top tax rate would come from a higher and broader GST, a crackdown on the black economy and the introduction of a broad-based land tax as discussed below.

Replace Stamp Duty with a Broad-Based Land Tax

The federal government’s 2015 tax white paper made clear that stamp duty is a far less efficient tax than land tax. Stamp duty is also a far more volatile source of revenue for state governments. Land tax is a very progressive tax with the wealthiest Australians owning the most property. It is also the only type of wealth tax that can be reliably collected, with property unable to be moved out of the tax jurisdiction.

The ACT government has shown the way with a gradual transition from stamp duty to land tax. Land tax encourages empty nesters to downsize, freeing up homes for families that need more space. Allowing older property owners to accrue their land tax and pay it upon sale ensures that people are not forced out of their homes. Land tax levels should be consistent across owner-occupied and investment properties. However, vacant land zoned for residential purposes and properties vacant for more than half of the year should be subject to an additional 200% rate to encourage the available housing stock to be utilised. Studies using utility data suggest as much as 4.8% of the existing housing stock in Melbourne is vacant for extended periods. Incentivising the owners of these properties to list them for rent would lead to substantial downward pressure on rents.

End Financial Repression

Financial repression describes measures used by governments to hold down interest rates. This is effectively a tax on savers with the benefit transferred to borrowers. As the federal government is increasingly indebted after years of budget deficits it benefits from low interest rates. By setting the inflation target for the RBA too high, the federal government is unofficially taxing savers for its own benefit.

The global evidence on the effectiveness of ultra-low interest rates has become clearer now that eight years has passed since implementation. Ultra-low interest rates have not materially increased wages or consumer price inflation, or business investment. Ultra-low interest rates have inflated asset prices, including Australian housing. Lower interest rates reduce the monthly repayment required to repay a loan. Many buyers have used lower interest rates to increase the amount they borrow rather than borrowing the same amount and repaying it faster.

The federal government should amend the RBA’s current inflation target of 2-3%. It could be changed to keeping inflation below 3% or to target an inflation band of between -3% and 3%. To prevent financial repression the RBA should also be required to ensure that the cash rate allows all citizens to receive a positive after-tax real rate of return. This can be expressed as:

An independent RBA should embrace this rule as it will stop the federal government from using financial repression to deal with budget deficits.

Increase Mortgage Risk Weights for Riskier Mortgages and Implement Macro-Prudential Measures

APRA has recently increased the minimum mortgage risk weight for major banks to 25%. This is a positive step, but it still fails to push banks to hold more capital against higher risk mortgages. The reduction in bank capital levels for residential mortgages since the financial crisis and higher loan to value ratios (LVR) have allowed potential property buyers to borrow more with smaller deposits. For instance, at an 80% LVR a $100,000 deposit caps borrowing at $400,000. At a 95% LVR the same potential buyer could borrow up to $1,900,000. Higher loan amounts create an arms race; potential buyers use their higher borrowing limit to bid up property prices in a market with limited supply.

There are several ways that APRA can act to reduce speculative lending. For mortgage risk weights, the 25% minimum that APRA mandates could be subject to a 2.5% increase for every 1% the LVR increases beyond 70%. This implies a 70% LVR carries a 25% risk weight, an 80% LVR carries a 50% risk weight and a 90% LVR loan carries a 75% risk weight. Macro-prudential measures should include limiting owner-occupied lending to 90% LVR and investor lending to 75% LVR. APRA should also ban interest only loans where the LVR is above 75%. In the current environment with historically low interest rates and elevated property prices these measures would substantially reduce speculative lending and reduce the risk of banks becoming insolvent.

Encourage International Buyers to Purchase New Dwellings

If the primary focus of housing affordability is ensuring a sufficient supply of housing available for rent, governments should be encouraging the building of new dwellings that can be rented out. International investment should be channelled towards buying new dwellings, with substantial disincentives for purchasing existing properties. There should be no disincentives or impediments to purchasing new properties. When combined with the higher rates of land tax for leaving properties vacant these measures should substantially increase the number of properties available for rent, putting downward pressure on rent levels.

Ease Zoning Restrictions and Eliminate Development Levies

Several states have made substantial efforts in encouraging higher density development, especially near job centres and public transport hubs. When transparent systems for zoning and approvals exist, market forces have responded and the supply of residential property has increased. However, many local councils see developers as a potential goldmine slugging them with substantial development levies. These levies are often a way of shifting ongoing council expenses from existing rate payers to those purchasing new properties. Local councils should be funding their ongoing costs and community infrastructure costs from all ratepayers, rather than shifting costs to potential buyers and worsening housing affordability.

Enforce the Law When Unions Act Illegally

Illegal union activities have a subtle but substantial impact on housing affordability. Construction unions are regularly engaging in criminal activities in order to fill their own coffers and inflate the wages of their members. This is a deliberate tactic. Unions have found that the benefits they receive from illegal activities far outweigh the fines and compensation to those who have suffered economic loss in the unlikely event they are prosecuted. By blocking non-union members from working and shutting down building sites that refuse union demands building costs have increased well beyond inflation levels in recent years. Large scale construction in Australia is far more inefficient and expensive than in comparable markets overseas. The cost of apartment towers, which should be the most affordable type of housing, would be substantially reduced if free market forces were allowed to exist.

Conclusion

Australian politicians like to talk about housing affordability but have taken little action whilst rents and purchase prices become ever more unaffordable. The actions needed are obvious when basic research is undertaken. The federal government should reduce the migration intake, lower and equalise top income tax rates, and make changes to RBA and APRA policy. State governments should replace stamp duties with land taxes, encourage international investors to buy new properties and rent them out, ease zoning restrictions, eliminate developer levies and enforce the law when unions act illegally. If Australian politicians care about housing affordability and the quality of life of Australians, they will quit talking and start implementing the eight obvious and needed changes.

Written by Jonathan Rochford for Narrow Road Capital on November 29, 2016.

The RBA quietly admits responsibility for bubbly house prices

This month the RBA quietly admitted that low interest rates have played a big part in the rise in Australian house prices. This comes after years of denying the obvious. I say quietly admitted as it came in a “research discussion paper” on its website written by two of its economists. The older of the two is in his 50’s and has worked in Treasury, at the OECD and at the US Fed over his career. Here’s the summary of the paper:

We build an empirical model of the Australian housing market that quantifies interrelationships between construction, vacancies, rents and prices. We find that low interest rates (partly reflecting lower world long-term rates) explain much of the rapid growth in housing prices and construction over the past few years. Another demand factor, high immigration, also helps explain the tight housing market and rapid growth in rents in the late 2000s. A large part of the effect of interest rates on dwelling investment, and hence GDP, works through housing prices.

In the introduction they note the following key relationships for housing:

- Interest rates, income and housing prices have strong and clear effects on residential construction

- Dwelling completions and changes in population explain the rental vacancy rate

- The vacancy rate has a strong and clear effect on rents

- Interest rates, rents and momentum have large effects on housing prices

- Housing prices and construction are mutually determined, so examining bivariate relationships in isolation can be misleading.

None of this would be surprising to someone who has observed the reactions of ordinary people (or the population as a group) to changing circumstances. But for economists who tend not to work with the real world so much this stuff is a revelation.

Note that the summary mentions lower world long-term rates, rather than directly attributing higher Australian house prices to lower Australian rates. I think that deflection may have been required to get this published as an RBA paper. However, it is clearly left open for people to read between the lines, that the RBA is mostly responsible for the house price growth in 2015-2017. With the benefit of hindsight, the RBA might have some regret over the four rate cuts in 2015 and 2016 that took Australian prices from overvalued to bubbly.

Written by Jonathan Rochford for Narrow Road Capital on March 15, 2019.

Closed borders have highlighted Australia’s population Ponzi scheme

Philip Lowe’s recent comments on the impacts of migration were basic economic analysis but hit a raw nerve for those invested in Australia’s population Ponzi scheme. Australia has long had amongst the highest net migration levels in the developed world, roughly double the level of Canada, the UK and the USA in the last decade.

This is not something that ordinary Australians wanted. It has been thrust upon them by successive governments seeking cheap economic growth, egged on by large corporations and the property/construction industry feathering their own nests. Whilst the costs of high migration levels have always been there, the largely closed borders and the comments by the RBA Governor have highlighted what many chose to ignore.

Background on population economics

In 2018 I wrote an article titled “the economics of population growth” which covered many of the issues also mentioned here. It was one of the most well received articles I’ve written with dozens of comments coming in from people who were sick of the costs of population growth (which are predominantly shouldered by ordinary Australians) being ignored.

I also took the opportunity to send the article to ten federal politicians across the major and minor parties. Except for two now departed mavericks who sent comments back in agreement, the rest didn’t respond at all. As I’ve found many times with various enquiries and policy reviews (particularly the insolvency changes in recent years) the non-response is the standard political way of dealing with inconvenient evidence.

The 2018 article has aged well, the key issues it discussed are still the key issues. Australia’s migration intake is poorly targeted, population growth is expensive to keep up with (e.g. infrastructure and housing), it drags down the quality of life for the existing population, it has both good and bad impacts on employment and it is used to mask the failure of governments to undertake long overdue productivity reforms.

The supply of labour impact

In his speech on July 8th, Philip Lowe noted that the lack of migration in the last year had reduced the supply of labour. CBA highlighted this in their recent analysis, estimating that close to 300,000 non-resident workers had left the country. This has an impact on low skill jobs like fruit picking and cafes/restaurants that employed many foreigners on seasonal and holiday visas. It’s now become much tougher to get employees in these sectors, with the underlying issues including some employers being unwilling to meet the minimum legal conditions and some unemployed Australians preferring welfare payments (often topped-up by cash in hand work) to taking a low skill job.

The reduced supply of employees has also shown up in higher skill jobs. The mining industry has long struggled to find workers willing to undertake remote and sometimes dirty and dangerous work, even with well above average wages. Cutting off the ability to import workers has created bottlenecks across their operations and has sparked an arms race in employment conditions. Similarly, the accounting, consulting and legal professions have seen their usual flow of migrant workers curtailed forcing them to increase pay to retain workers and attract new employees.

These are positive developments in several ways. Unemployed Australians now have more choice about the work they choose to do but also fewer excuses for not taking available work. If there is a job open nearby, the default position should be for an unemployed person to take it and then spend their spare time upskilling and applying for their ideal job. Employers that routinely cheat their workers will struggle to find employees, as the pool of vulnerable foreigners has been reduced. Criminal prosecution of wage theft is good, but market forces can bring a much faster resolution.

Governments and employers now have a clearer picture of what skills are needed and where training should be directed. The border closures should create a greater focus on trades and a lesser focus on university courses, particularly lifestyle courses that have poor employment outcomes.

Housing affordability

Federal and state politicians disproportionately own property. Unsurprisingly, they routinely enact policies that inflate house prices. These issues have been chewed over many times and the answers never change. What is unusual in the current situation is that housing stock is growing rapidly, when population growth has stopped. This is great news for the poorest Australians, who should see downward pressure on their rents in the coming years. The combination of higher employment/wage levels and a lower cost of housing can substantially lift the living standards of hundreds of thousands of the poorest Australians if politicians don’t stuff it up by importing hundreds of thousands of people.

When the borders re-open

The fact that international borders have been largely closed provides an opportunity to permanently reset migration levels at a small fraction of what they were. Those granted the right to migrate to Australia should be people expected to contribute disproportionately to the tax base. The minimum income test should be set at a high level such as $150,000 to ensure that employers are not shirking their responsibility to train Australians for ordinary jobs.

At the low skill end, the number of working holiday visas should be slashed. Unemployed Australians in regional and rural areas can be put to work on farms and those in the city can get to work in cafes and restaurants. University students (both domestic and international) will continue to provide a sizeable pool of low skill labour. International students should be given fair warning that few courses are likely to lead to permanent visas.

The shift away from population growth should cause a shift towards productivity focussed economic growth. I’ve written about this many times, with much low hanging fruit to be picked amongst excessive regulation and government spending, high and inefficient levels of taxation and anti-competitive government/business practices. Something as obvious as having a simple and universal minimum wage for small and medium-sized businesses could see businesses expand and unemployed Australians shifted into work, leaving almost everyone except the lawyers better off.

Written by Jonathan Rochford for Narrow Road Capital on 14 August 2021.