The US leveraged loan market has had a tough year but the pain is set to continue for years to come. At the start of the year margins were low and competition for allocations was fierce. Savvy investment bankers and borrowers used the conditions to their advantage stripping away covenants to record low levels. The market bust up in March saw loan prices collapse, with the Covid downturn slashing the earnings of borrowers in industries most exposed to the changed conditions. (e.g. hotels, casinos, retailers, oil & gas) You would expect lenders to respond by banding together, pushing business owners to invest fresh capital and forcing decent covenants into new deals. Bizarrely, lenders have responded by going feral on each other and allowing business owners to further exploit them.

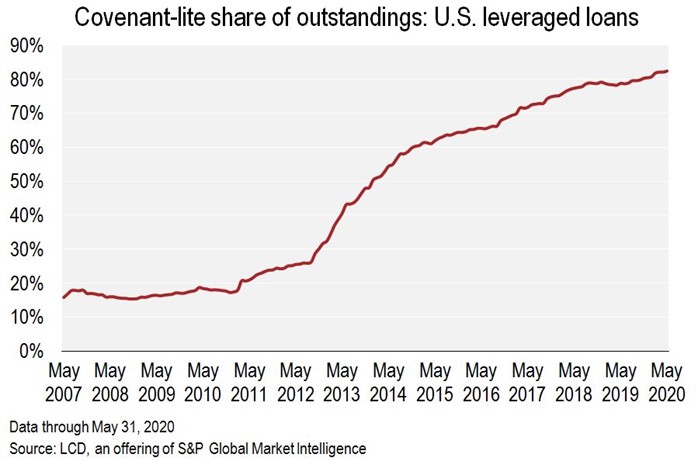

The seeds for the current problems were planted back before the Financial Crisis when the covenant light trend began. The financial crisis saw loans with less covenants perform better than loans with full covenants, a result that many have chosen to wilfully misrepresent ever since. The key to the difference was covenant light was then a privilege granted to companies with lower debt and better sponsors/shareholders. Lenders knew then that combining poor covenants with the highest risk borrowers would be suicide.

What started out as a privilege last boom has become a de facto right this boom, with over 80% of loans lacking decent covenants at the start of this year. Borrowers had often negotiated rights to allow their credit ratios to blowout (no maintenance covenant), to introduce additional debt that supersedes existing debt and to strip assets from lenders (weak security protections) without consequences. Some borrowers have been willing to take full advantage of their contractual position setting aggressive precedents.

The nastiest development has been borrowers playing lenders off against each other, using the ability to offer a priority ranking as a carrot for new debt. Borrowers that would either go into bankruptcy or undertake a debt for equity swap, in either case reducing their debt load, are instead taking on more debt. Existing lenders are forced into a subordinated position, seeing their loans devalued and their prospect of a full recovery substantially reduced.

This development follows a series of highly contested legal battles over asset stripping. Aggressive business owners have transferred real estate and intellectual property out of the borrower group; moves that strong covenants would have blocked but covenant light loans can allow for. Despite the dangers of weak covenants now being obvious, lenders are giving away even more standard covenants.

Several recent deals have allowed for the transfer of debt to a new borrower, rather than having the standard requirement for repayment in the event of a business sale. This previously standard protection allows lenders to reject a transfer of debt when the replacement borrower is of lesser quality. The covenants and margins that would be appropriate for a BB rated company wouldn’t be appropriate for a CCC rated company, but without solid covenants lenders would simply have to cop the change. Dividend recapitalisation deals have been popular in recent months, adding more leverage to businesses so that owners can cash out part of their investment earlier.

The outlook for leveraged loans now looks poor with a first wave of clearly distressed borrowers needing attention and the potential for a second wave should the Covid related economic damage last longer than expected. The lack of covenants will make for delayed bankruptcies and restructurings, with borrowers inflicting greater losses on their lenders as a result. The thing that keeps many investors from selling out is that they can’t see an alternative offering a decent yield, with safer debt typically paying yields below inflation. This is yet another example of the zombie economy consequences created by Frankenstein monetary policy.